Monday, June 10, 2013

Traveller's Tales 2013: Why We Do What We Do

Tuesday, December 6, 2011

2011 D-Bag Awards: Nominations

Last year, it was almost in the bag for the Grim Reaper, himself but BP pulled ahead thanks to an environmental disaster and all around mucking up of the aftermath. Still, Death shows he’s a competitor as he comes back for another year as a probable finalist. While BP fires only a single d-bag worthy shot with a claim that Halliburton destroyed evidence from the Gulf Oil Spill. Nice try BP, but we’ll hope you can do more to represent your place in d-bag history next year.

- Courtney Stodden

- The Kardashians

- Brooke Mueller

- Michael “The Situation” Sorrentino

Celebrity – They’re famous for being infamous across movies, television, and music. Pop Culture will cry in a corner for years to come.

And the nominees are:

- Chris Brown

- Charlie Sheen

- Lindsay Lohan

- Brett Ratner

Business – If I could name them all and fit them on the ballet, I would. Simply put, they make up the 99% of the d-bags in this world, but alas I had to narrow it down to four.

And the nominees are:

- NetFlix

- Bank of America

- PayPal

- Retail Industry

Sports as a Business – The individuals are pretty bad. However, the companies and brands behind them are simply baggerific.

And the nominees are:

- The NBA

- The NFL

- The Pittsburgh Pirates

- PSU

Sports People – These folks made a name for themselves being douchebags in the realm of sports.

And the nominees are:

- Jim Tressel

- Jerry Sandusky

- Jerry Meals

- Roger Goodell

D-bags That Have Affected People - OK, this one is a bit of a potpourri of d-bags. I couldn’t find anyway else to slice it so these folks were d-bags to people’s lives and property.

And the nominees are:

- Mother Nature

- Death

- Vancouver Stanley Cup Rioters

- John Pike

News/Media D-Bags - These D-Bags are a part of the fabric of our culture. They haunt the Internet, the checkout aisles, our televisions, and our phone conversations.

Julian AssangeMark Madden- Rupert Murdoch

- Old Spice

- Perez Hilton

Wednesday, July 29, 2009

Chase-ing Your Own Tail

Of those three credit cards I’ve carried, I will say that the GM Master Card has been the kindest of creditors. My National City Visa is sitting there waiting for me to use it, and my wife’s Discover Cards are collecting cobwebs, which is how I like it. Quite frankly, I would have never even opened a credit card if I hadn’t decided to buy a house in 2004. I opened a Visa card, bought something and paid the balance when it was due. I started to establish credit with that single purchase and since then everything has gone downhill. We’ve moved from one card to another carrying a portion of a balance that started three cards prior. I slowly began to whittle down my debt.

First off was my GM card which I could use to get cash towards a car purchase. Once I finished off the major balance on that card from the Ghosts of Christmas Past, I decided to help my wife pay down the Chase card. It contained the remainder of our credit card debt attributed to her previous cards and I thought I’d be a good husband and help pay it down. What started out as progress turned into a dance with the devil, and I was leading.

Now, my wife and I are two different types of payers. She likes to physically mail a check each month to Card Services, while I like to use the online services to schedule payments directly from my checking account. I can set it and forget months at a time. Also my wife likes to pay things over time, disregarding the huge finance charges on our existing balance, whereas I like to take every extra cent I can allocate away from other things and throw it at the principal along with monthly payments. To tell the truth, I spent the last four months sending GM a payment of about $20 a week just to keep from having a bigger payment at one time. They (HSBC Card Services) might have hated seeing those transactions once a week, nibbling away at my balance, but I was able to free up my thoughts towards other issues and not take a huge hit in the wallet while doing it.

I know a lot of people who will side with my wife when it comes to seeing a physical bill, sending a physical check, and knowing that you took care of it instead of setting up complex payment schedules based on the tides and phases of the moon. Yet, I can take off my shoes and count up all the times she has come to me and said, “Oh, crap! I forgot to send the check. Can you pay it online tonight?” “Yes, dear.” I would say and two minutes later I had an email thanking me for my payment.

However, my lifestyle did not allow for one thing, a single digit, left off the end of my checking account. My wife paid a little more than the minimum payment each month and in the middle of the month, I would send in an additional payment online. I thought everything was fine until I noticed that the balance of the card was climbing and my checking account statements weren’t showing debits toward the card. I logged into Chase’s online service and saw that each month there was two line items from my account. One was asking for a payment. The other was returning the payment. Additionally, there was a $39 returned payment fee showing up alongside the reversals. After two months, I had accrued $117 in charges to the account.

For the most part, I regard mail as a privilege. When I open the mailbox and see a stack of envelopes I get a little excited. Once I get inside, however, I lose more and more of that excitement as I sift through garbage and junk mail. A lot comes from credit card companies looking to snag you into their web of deceit. Even some of the mail comes from your own credit card companies touting a low interest rate for transfer of balances or other services. These usually get shredded or thrown into the fireplace for kindling. So, it came to pass that I disregarded two small perforated card stock letters informing me that my account had returned a payment because there was a problem with the account. When I did notice them, I took it as an error on their part, not mine. After all, I’d been using that checking account for almost 20 years. I’ve never had problems with them before. In fact, last year, Comcast…another good honest friend of mine…*cough* rip off *cough* decided to not draft a payment from my checking account, one month, and then drafted $300 the next month. The reason they cited was that there was a problem with my checking account. Further investigation revealed the error on Comcast’s side of the board. I called my financial institution and they had no record of an attempt to draft off my account. Apparently, Comcast has technical glitches between the keyboard and the seat all the time and I had to suffer for it. I treated this issue with Chase as the same problem, they screwed up.

Another month went by and another letter came. It happened again. My wife decided to call Chase for some answers and after going round and round over the matter, she handed me the phone. When I spoke to the customer service agent he told me that the account in question could not be found. Now that was a different story than problem with the account. Problem with the account infers that the account is there. You can see it, touch it, taste it, smell it, but it has a weird flavor and looks to have gone bad, recently. The account not being found means that you’ve walked to the fridge, opened it up and asked “Where’s the Sunny D?” After hearing, “Did you check behind the milk?” and “Well, is it behind the soda?” you realize that you’re all out. It wasn’t until the agent had me read my checking account number to him that the problem became clear. They were looking in the fridge of my life for Sunny D and found Tang. In other words, when I entered in the account information to set up the payments, I dropped off the last digit on the end of the account number.

Playing on the sympathy of the economy I pleaded with the agent to forgive the charges as it was apparent that we were trying to pay the card, but the account number was too short. He said that due to a policy change he couldn’t forgive the charges but gave me the name and address of the VP of card services at Chase in Ohio. He told me to write a letter asking for the charges to be dropped and said that only he could do it.

So, we’re off to see the wizard and I’ve even brought along the witches broom in the form of statements showing the payments and reversals as well as the payment schedule proving a difference in account number from the payment account for the problem payments as well as the corrected account number at the top. We’ll just have to wait and see if the wizard is nothing more than a humbug.

To top things off, I just checked the account and a message had shown up in my inbox. Back at the beginning of the month, I sent them a message asking about the charges. They finally replied, deducting one of the charges from my account. Well, apparently, the guy manning the online stuff has a little more power than the guy on the phone. Yeah, and monkeys might fly out of my butt.

What a world. What a world.

Friday, April 3, 2009

Cult of Wessonality

The economy is in the outhouse and most of America is in the poorhouse. Well, not everyone. The tenet of “He who dies with the most toys wins” is alive and well in America. In recent weeks, there has been more fingers of shame pointed at bad behavior then ever were, domestically, in the past few years. To equate to an office environment, the Obama administration is calling everyone into the break room and informing us all that we are all required to work more efficiently and cut down on expenditures. Usually, the boss wouldn’t name names in public. He’d address the group as a whole allowing the guilty parties some anonymity in order to change their actions but folks from AIG to GM are still thinking that the Administration is talking about someone else and continue to do business as usual. Finally, Obama had enough and publicly called out AIG for its bonus scandal and also asked Rick Wagoner to step down as CEO of GM. Both of which have had polarizing effects on the public and the economy.

Then the question arises, should Obama have done it? Is this positive movement towards that ‘change’ thing he spoke of for months prior to the election? In a word, yes. There are those who think that it’s not the job of the White House to make these requests. However, who’s job is it? It’s obvious that the reason we are in this mess is because no one bothered to watch the trends. It’s not just the fault of the previous administration, but it’s their fault that is wasn’t stopped sooner. The fact remains that this is a country of the people, for the people, and by the people and we have every right to question what we think is wrong, whether you are for the current administration or against it. Either way, we gave the administration the right to cover our asses.

When we elect an official to put our best interests forward, we give him/her the power to speak and act on our behalf. When that entails our tax money being used to bail out troubled corporations, whether they deserve it or not, the official exercises, by proxy, our wishes. Therefore, we and the elected official acquire the ability to make that call. Now, the President can ask for the resignation of Rick Wagoner, but it was up to the board of GM to approve it. There is the rub. Everybody talks about how this is the first step towards Socialism when all it is calling out someone for farting in the car. As long as you ignore the problem, Stinky McGee will keep letting them rip.

Then there’s the case of Bank of America wanting to spend TARP money on sponsorships for sports deals. Well that’s just great. We just gave Jack our only cow to sell and he came back with magic beans. It’s like giving someone money to pay off their debts and instead of doing just that, they turn around and try to double it at the craps table. I didn’t spend my stimulus check or tax refund on scratch and win tickets. I paid off some debt and bought some items for the home. I stimulated the economy.

Maybe we’re asking for too much here. Maybe bailing out these big companies was a bad idea. We hoped that by shoring up their assets, they’d help grease the frozen wheels on the economy and get it going forward. Instead of doing that, perhaps a better message to them would have been to reap what they sowed. Of course, letting them fail would have been the first domino in a huge That’s Incredible display that would have made things worse. Yet, everyone was so quick to get the TARP money out to stop the bleeding that nobody bothered to make sure that we were stitching up the wounds and not just putting a band aid on it. There should have been some provisions on how the money was spent. Grants given with some language attached that specified the purpose of the money. Instead we gave Joe, the copy room guy, an expense account and sent him to Vegas for a conference. Now, AP is looking over Joe’s expense report and asking, “What the hell is this $500 charge for special services?”

Here in Pittsburgh, we faced a similar situation. The city was given a grant in the neighborhood of $400 million dollars, to construct a tunnel from the main part of the city to the North Side. The purpose was connecting downtown with the main sporting areas and a new casino that is being built near them. In a time when the city was in jeopardy of losing a major hockey franchise, needed a new arena constructed for sporting and other events, and also needed major overhauls to the transportation system and road infrastructure, it seemed silly and irresponsible to spend that kind of money on an underwater tunnel for an underused light rail system. Yet, that is what the money was allocated for by its donors. We didn’t have a choice. We either had to use it or lose it. So, drilling and construction began on what is called the North Shore Connector.

Now, there is talk that it may not be completed because of a ballooning budget due to materials and the poor economy. Still, the money, given to the city, was specified for a certain project. Not like the drink tax or Onorato tax, as we like to call it, which give the city the ability to add a 10% tax to alcoholic beverages in order to pay for the Port Authority’s budgetary expenses. When the final tabulation was made at the end of its first year, there was a huge surplus beyond what was forecast. Instead of using that money for its intended purpose, Onorato wanted to spend the money on other projects like bridges and roadways. This was met with huge amounts of criticism because the opinion of instituting this tax in the first place was a major point of contention with residents who were then threatened with the idea that if they don’t pay the drink tax, property taxes have to go up. Let’s say the shoe was on the other foot and the Bar and Restaurant Owners Association was hurting for money. If the Port Authority had added a tax increase on transit fares to help them out, which they would never do, and the Bar and Restaurant Owners Association decided to use that money for other expenses instead of their budgets and payrolls, there would have been a major uproar over the issue.

Now, in the case of public opinion over the economy, we need to either be a little more patient and make more concessions. This was my biggest fear when Obama was elected. Not ‘what’ he would do, but how we would perceive it. We believed in change, yet we want someone else to do all the work. We need to take a little more responsibility for making things happen. That goes for unions, CEO’s, and everyday Americans. Our short attention span approval ratings need to get a reality check and we better start realizing that we need to be the force behind change. The coach can call the plays. He can design them, inspire us with a rousing “Gipper” speech, and give us all the tools for success, but ultimately, we have to go out on the field and win the game. For once, in a long time, there has been no glossy film put upon a Presidential Administration. We got what we asked for and there’s been no attempts to hide any actions. It’s just time for us to grease the wheels a little bit on our own and make the country go a little smoother. Thing is, we all have to give it a little push.

Tuesday, March 10, 2009

15 Companies that might not make it in 2009

- Rite Aid

- Claire's Stores

- Chrysler

- Dollar Thrifty Automotive Group

- Realogy Corp.

- Station Casinos

- Loehmann's Capital Corp

- Sbarro

- Six Flags

- Blockbuster

- Krispy Kreme

- Landry's Restaurants

- Sirius Satellite Radio

- Trump Entertainment Resorts Holdings

- BearingPoint

Looking at this potential list, I only recognize half of the companies, a product of my sheltered Southwestern Pennsylvania life. I can only speak to those I am aware of, so this is not a complete analysis by any means.

Rite Aid

Perhaps the first major retailer to fall in the wake of Wall Street’s woes not solely at the fault of Wall Street. You can probably bet on seeing more stores like this collapse under the weight of Wal-Mart’s integration into everything America, especially during a recession. If Rite-Aid does go, keep an eye on CVS. They have roughly three times the revenue as Rite-Aid but again, competing with Wal-Mart is like going into a gun fight with a spork.

Claire’s Stores

One of the last bastion of 80’s fashion accessories, I’m surprised the chain is still around. Blame a hefty acquisition by its parent, Apollo Group, last year for signs of doom and gloom. These are the same folks that bought Linens-N-Things right before they went bye byes. Another factor, mall traffic is waning as people tighten their belts further.

Sbarro

Not even Michael Scott’s love of the Italian eatery could be enough to save them. Their financial standings aren’t that bad. Again, mall turnout is a definite factor in the loss column as is their competition from juggernaut’s Dominoes and Pizza Hut.

Chrysler

If The Detroit 3 were comparable to the Laff-A-Lympics, Chrysler would be The Yogi Yahooeys. They’re not as evil as The Really Rottens (GM), but not as strong as The Scooby Doobies (Ford), which boasted powerhouses Captain Caveman and Blue Falcon. You just can’t compete with one team that is pure evil and the other which has better players like the Taurus and F-150.

Blockbuster

The media rental giant has been fighting an uphill battle ever since OnDemand became part of the digital basic service. Not to mention, they didn’t make any friends with their problems concerning late fees a few years ago. While they’ve tried to compete with NetFlix in the online mail order service, their brick-and-mortar approach is their strong suit and unfortunately bad economy equals less trips to the store and more home rental service through cable and satellite providers. While die hard cine-philes while still go to the store to rent DVDs for the extras, the general public has only the attention span for the movie by itself and needs only one night to watch defeating the no late fee perk Blockbuster has adopted. Similarly, my own local Supermarket staple Giant Eagle did away with its DVD and game rental service in house and opted for the vending machine style Red Box kiosks outside the store. They’ve already surpassed Blockbuster’s number of locations and require no Kevin Smith and Quentin Tarrantino types on the minimum wage payroll.

Sirius Satellite

Desperate times call for desperate measures. In this economy people are going to start looking at the things they can do without and a subscription to satellite radio is not safe even with Howard Stern as its biggest feature. As XM and Sirius decided to join forces instead of die alone in the satellite market, HD radio has tried to carve out its niche by touting more music for free. Frankly, I can’t find enough good music to listen to on regular radio, why would I pay for satellite or even an HD receiver both of which could cost hundreds of dollars. I’ll stick to my iPod and NPR for my tunes and news. Most people will either resort to buying CDs or songs from places like iTunes and becoming their own DJ, commercial free.

Krispy Kreme

Talk about having two strikes against you. The donut giant exploded onto the scene in the 90’s and its impact was much like a sugar rush. Fun and exciting at first, but the withdrawal and crash later was detrimental. First off, the healthier conscious America began shunning the franchise, which started closing locations, some months after they were opened. Now, with the recession, donuts are less of a necessity and more of a luxury. Unless the stimulus package can gave an insulin boost to the economy, the Hot Light may go out for good.

Six Flags

This one surprised me. Granted, they bought up the defunct Sea World park in Ohio, before turning around and selling it to Cedar Point’s parent group Cedar Fair, but being paired with a Hollywood Giant Warner Bros. should count for something, right? Six Flags has been in trouble for years with investor issues and having to sell off assets to pay off debt. Unfortunately, the economy has taken the plunge over the lift hill and it’s a hell of a drop before it goes into the next hill. Bad economy = no money = no vacations = no riders = no fun.

Trump Entertainment Resort Holdings

The fact that the namesake left in February should give you an indication of how bad things are. They also filed for Chapter 11 and casino buying is the third rail in a bad economy. No one will touch them. People aren’t going to gamble what little money they have, especially if they have to travel outside a certain radius and possibly pay for lodging as well.

You have to take these prognostications with a grain of salt. It shouldn’t take a psychic to see what sectors of the economy are going to suffer the worst in a recession. Entertainment, luxury items, and businesses that have direct competition with other businesses that can undercut their prices are going to suffer. A powerhouse like Wal-Mart can pretty much outmatch any niche store because of all of its offerings.

The bleakest looking outcome for this mess would be that only two things will be left standing, the U.S. Government and Wal-Mart. In that scenario, Wal-Mart will buy the U.S. Government, offering to handle all of its services at a discounted rate, and we will finally be under the rule of the Chinese. In this case, learning “Would you like fries with that?” is not going to help you.

Tuesday, February 10, 2009

McScrewed

Bailouts.. TARPs… Recession… Stimulus… No matter how you label it we’re a little McScrewed. I use that term because that’s probably where I’ll end up working with the way things are going. The government seems fit to throw money at organizations that have shown they can’t be trusted with money. The promise is that the Federal Government is giving IOU’s to banks to stabilize credit and in return they pay back the loan with interest. In theory, there should be a profit.

Now, I don’t know about you, but the last time I used an IOU was when I was a college student and a little short on cash around the holidays. I used my student computer account and Photoshop to create these little “Coupons” for my parents that basically stated that I would clean out the garage or wash the cars instead of buying them a present. That was 15 years ago and I never did make good on those IOUs. So, how do we know the banks will pay back the Government? In essence, the Government just became Fannie Mae and the banks became the American homeowner who bought a sub-prime mortgage.

For the most part attitudes have changed but still people are conducting shady business as usual. John Thain, there’s a guy we’ve all read about in the news, he was the Merrill Lynch CEO that used $1.2 million dollars to renovate his office and gave out billions in bonuses to executives days prior to the sale of Merrill Lynch to Bank of America. In his defense, he cited that a lot of the losses Merrill Lynch suffered were due to his predecessor. Ok, the man had a $1400 garbage can in his office. You tell me who is to blame for this? Oh, and his answer for why he gave the bonuses, “if you don't pay your best people, you will destroy your franchise.” Well, guess what, Bucko. You were supposed to be the best and you almost destroyed the franchise.

This type of mentality doesn’t surprise me when you hear about all the rumblings along Wall Street in response to President Obama’s decree that salaries will be capped at $500,000 for executives of companies receiving TARP funds. Now, there is anarchy and bedlam in the board rooms as executives find themselves suddenly in a salary freeze. What to do? What to do? Rudy Giuliani has said that if you take away bonuses and incentives from these people that the rest of New York will suffer from reduced patronage at restaurants and other establishments. Sorry, Rudy, but these guys aren’t going to McDonald’s or even Houlihan's and they aren’t creating unemployment buy losing a few zeroes in their paycheck. They already created unemployment by letting their companies become so screwed up.

Look, if you are a company that is going to the Government and asking for millions of dollars to help keep you afloat then you need to tighten your belts, too. Guess what? Everyone else has to so don’t think we’re picking on you guys. My salary got frozen along with a lot of other folks’. You’re going to have to start living like the rest of us. If you can’t, then you’ve proven our point. You work for a financial institution for pity’s sake. Did you not learn how to manage your money? Now, if your company was solid and didn’t need financial assistance from the TARP, then by all means, do what you want. By that token, you should be acting responsibly and mindfully of the economy. If anyone believes we’ve already seen the bottom of this hole, then they’re just as delusional as bonus backed bankers.

Just like we, as regular taxpaying, nine to five working folks need to realize that everything didn’t change in November. You try stopping a speeding locomotive on a dime. It’s impossible, even for Superman, and sorry to say, Obama is not Superman. No one is. It’s going to take a lot of time and patience to slow this speeding train and get things working properly. Unfortunately, we are an short attention span audience. We want something to happen right now. We want our credit lines to be fixed, our jobs saved, and our President to wave a magic wand and make all the bad people go away. An economic stimulus package won’t solve all the problems. In my opinion, I don’t think I’ll be getting one of those rainbow sherbet looking checks with the Statue of Liberty on it. I think this package is more for the businesses that give us our other checks, the ones we get every other week. That’s so we can keep getting them. This isn’t a hand out. This is an opportunity to create jobs to fix roads and bridges. It’s a chance to upgrade our cities instead of building up on the degraded infrastructure that has been allowed to lapse into the old standards of the 20th and in some really depressed areas, the 19th centuries.

Is the Government doing the best they can for the nation. I hope so. I don’t think you can narrowly point to one man, one company, or one administration and say, “Shame on you.” This has been allowed to go on for years and people figured, it’s only wrong if you get caught. Somebody out there screamed and waved their arms, trying to be heard as the voice of reason and was ignored as is usually the case in any disaster movie. Well, now the economy could be the basis for a new Michael Bay or Roland Emmerich film, in fact they’re probably sitting around trying to figure out how to work in huge explosions to take out their fictional Fannie Mae’s or Lehman Brothers. Be sure that Hans Zimmer is firing up the synthesizers trying to find the right set of chords to play as President Obama, as played by Will Smith or Jamie Fox, slowly stands up with that stern look on his face as the camera pans up and around him in slow motion. This is the moment you’ll be waiting for because that when he’ll get pissed and go on the offensive, taking out bankers left and right without having to reload. Once you wake up and realize that life is not a movie, albeit almost a bad one, you’ll go back to your job, look at other companies’ postings and wildly throw your resume about hoping that one of them is in better shape and willing to hire you.

If you think that throwing money at the problem will make it go away, then all you’ll do is live from bailout to bailout, stimulus to stimulus, and we’ll be right back where we started when this whole mess reared its ugly head. We all need to be aware that it’s going to get worse before it gets better. We need to change our course as individuals whether we make $500,000 or $50,000 a year. We need to realize that when it does get better, it won’t stay that away. We need to be ready for the next big hole or out of control locomotive, otherwise we’ll be saying “Would you like fries with that?” instead, “I’d like to supersize that.”

Get your own McScrewed shirt or magnet here.

Thursday, December 4, 2008

Black Friday, Cyber Monday, and Every Other Day Between Now and Christmas

Whether you are a die hard bargain hunter standing in line during the wee small hours of the morning of Black Friday or a cubicle warrior taking advantage of the empty office and lack of supervision on Cyber Monday, you probably feel the same amount of stress, regardless of your location.

Imagine shrugging off the effects of late night, leftover tryptophan ingestion just so you can stand in the freezing cold with other lunatics in sleeping bags and tents waiting for the doors to open so you can make a mad dash for that DVD/VCR combo unit made in China. You sprint towards your quarry like a linebacker, mowing over anybody who gets in your way all to save $20. On the other hand, you could be digesting those leftovers all the way through to Monday, where you arm yourself with a tankard of Starbucks digging through countless retail websites looking to see if you are really saving any money only to make up the difference in shipping costs and aggravation at continually slow connectivity that sends your IT workforce into panic mode.

Personally, I’ve done both and could do without either. In 2000, I made a trip out on Black Friday and found myself a stress free go of the adventure. Granted, I had to work that morning and didn’t get out to the store until well after 11:00 AM, which, in contrast to deer hunting is when all the big bucks show up. I went out again this past Black Friday for one item, Vanilla Beans for my mother. Again, I had to an earlier appointment and didn’t make it to the store until the sales had ended. It’s amazing to watch people suddenly drop everything and run to the checkout when the clock strikes “SALE OVER!” I also decided to check out Cyber Monday from the comfort of my living room and bought two items online that were discounted by 50%. In this case, according to customer service the website could not process my order due to a “glitch” which kicked out a lot of online purchases. The order did not process until Wednesday and the website shows those two items for the same price as they were on Monday.

Shopping on these two pseudo holidays has become a tradition. The term Black Friday, itself, has many recognized definitions since its inception. The more widely accepted one being the day retailers start to see black on the financial records. In fact, a lot of stores depend on this day to counter balance the year’s losses. Cyber Monday has only been around since 2005, but people revere it as a day when those few unfortunate souls have to go back to work yet shrug off productivity to shop online. Whether it be the struggling economy or a slew of other factors, this year the concept of Black Friday and Cyber Monday seem to either be nonexistent or extend past their respective weekdays.

For me, the stress and agitation of the holiday season only started creeping in the last eight years. It was like once I hit 25, it all went downhill. Social anxiety, road rage, and general laziness all kicked in at once and I didn’t want to be bothered with crowds and slow Internet connections. Not to mention, it's not safe. This year will be forever remembered as the year a Wal-Mart employee was trampled to death by the mob of bargain shoppers. This is perhaps the greatest shopping related act of senseless violence since the Cabbage Patch Fights of 1983. It's even sparked a proposed "Doorbuster Bill." Sounds like Bob the Builder's more aggressive cousin. In my sick and twisted mind, I wanted to start humming old School House Rock ditties, changing all the words to make it a relevant parody of this year's tragedy. I opted not to.

In all seriousness, no sale is worth risking your life or sanity over. I would rather pay 20% more at the store in December than lose my mind and a couple of teeth, fighting with the crazies on Black Friday. Quite frankly, the savings aren't all that great. After all, some stores are using the recession to take advantage of people. Some have touted big savings but they aren’t any different than any other day. Others have used Black Friday like coastal beachwear stores use “Going out of business” and “Store Closing” as a tactic to drive sales. If you’ve ever gone to Myrtle Beach or other coastal tourist locations you see these beachwear stores like WINGS and others, all claiming to be going out of business. These stores have been going out of business for years. Because most vacationers stay at a spot a week at a time the turnover rate for new suckers is every seven days. The prices on items in these stores are no big savings. They’re slightly marked up enough to make a profit and the threat of going out of business deceives shoppers into thinking the prices were higher before. If you don’t believe me, ask someone who lives in those areas full time.

No, I’ll take the 25 plus days of shopping between Thanksgiving and Christmas to get my shopping done. Why stress yourself out. It’s supposed to be a fun holiday, right? I can remember as a kid that the holiday shopping season was rather exciting. My Dad would be at Lions Club meetings on Monday nights, so my Mom would do her shopping then. Since she didn’t want to cook a big meal for the two of us, she decided that we would eat at the mall. Monday’s were a rather slow day anyways, so it wasn’t too stressful. By the time, I was in my teens, we would decide to split up at the mall and I could loiter or hang out in the arcade or do whatever until time to meet up to go home. It was awesome. For four straight Monday’s I had free reign at the mall. And it wasn’t like we went to the same mall. No, there were different stores that she needed to go to and you couldn’t find them all in the same place. We used to go to three different malls in a 40 mile radius which meant three different arcades, video game stores, and food courts. It also meant an overload on Christmas decorations. The music and the decorations made the season bright, you know? Who doesn’t remember the animatronic displays in the middle of the halls and the poor bastard that had to sit inside that cleverly disguised gift box booth with a giant reindeer spilling over top, complete with blinking eyes and movable maw. As kids would wander by, Rudolph, the sadistic hourly employee would scare the piss out of their Garanimals, springing to life and asking them if they’ve been good this year.

Well, at least one trend from my childhood has made a comeback in this slumping economy and that’s layaway. There were three small market chain stores in my area that highly utilized layaway and all three fell victim to the evil empire known as Wal-Mordor. Montgomery Wards (a.k.a. Monkey Wards), Ames, and Hills. Well, actually Hills was acquired by Ames, which later fell to Wal-Mart. It’s like the subprime mortgage crisis for a different generation. Personally, I only used layaway once to buy something that I needed to hold somewhere else while I moved. It was a curio cabinet for my wife and I was in the process of moving and didn’t want to have another box to potentially destroy, so I put it on layaway and paid it off after I was settled into my new place. Wards, Ames, and Hills, were the big three local department stores for the blue collar folks of Western Pennsylvania and layaway was the method in which to avoid high prices upfront and credit card finance charges. You put a down payment on your item, and systematically pay it off over time. All the while, your item is held at the store or warehouse freeing your home from prying eyes that belong to kids snooping for presents. Hills was especially a great store because that’s where you got all the toys as a kid. I remember seeing a Nintendo for the first time, immediately to the left of the entrance, in the electronic section. I wished and I prayed that I could get one for Christmas but that never happened. Instead, I bought a friend’s system for $100 with three games and a big strategy book.

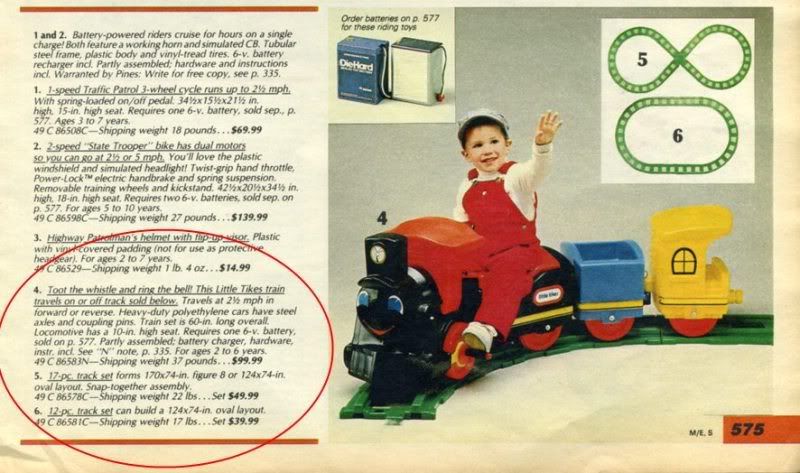

If you didn’t go to the store, your options for shopping were pretty limited prior to 1995. Granted, we had our own version of shopping online as a kid. It was called catalog shopping. My favorite was the Sears catalog or “Wishbook.” I read those catalogs like they were crime novels, riveted by every page. The one thing I always wanted, but never got, was a train set. Now, this was not some regular old train set from TYCO or Lionel. It was a huge, honking thing that you rode with tracks laid throughout your home. I blame Silver Spoons for causing me to salivate, over this thing, every year of my childhood. I would dog ear the pages of the catalog in an attempt to draw my parents’ attention to that one item much like Ralphie Parker placed a Red Ryder BB Gun ad inside the pages of his Mother’s Look magazine.

The one Christmas Present that got away

But those days are gone. While layaway has made a comeback, the fun and pure joy of leafing through a catalog is gone. Perhaps growing up stole my passion for it. Perhaps the magical allure of Christmas shopping has been replaced the harsh reality of having to actually budget and finance, not to mention having the tag of “Some Assembly Required” mean “I must assemble” vs. “Dad, put this together.” I wish Christmas shopping was still that fun. I wish that I didn’t have to fight the crowds and nitpick over ridiculous pricing ploys that I know are too good to be true. I wish I could go back and be a kid again and believe that Santa brought me my toys and not my parents who had to figure out new and inventive ways to pay for and hide the presents. Well, for that matter, my Dad never had that problem. You see, my old man didn’t believe in Black Friday, Cyber Monday, or any other day between now and Christmas. He did his shopping all in one night, Christmas Eve, much like Santa Claus. Of course, this holiday is traditionally called Piss On LEGO by my family, but that, is another story.

Need some more nostalgia? Check out a bunch of old Christmas Catalogs, including the Sears ones I referenced. Brought to you by Flickr

Tuesday, November 25, 2008

Snakes On A Plane

This past week, Moe, Larry, and Curly....(actually, it’s more like Shemp since Nardelli just showed up last year) went to Washington to ask for some of the bailout funds. While people travel everyday by commercial airlines and pay high ticket prices and baggage check fees for around $800, these three yahoos decide to use their corporate jets to fly to D.C for about $20,000. I’m sorry, but did anybody bother to tell them why they needed the money or did they just figure they felt left out? When I was in college there were a lot of pan handlers out on the main road through campus. They’d stand there and ask for change as you walked by to class or the bar. On occasion, I did offer up a few bucks, but they failed to realize that they were asking college kids. We have no money. And while they did that, they wore $150 Nikes. Hey, pal, you might want to look the part. If they (The Big Three D-bags) expected to be taken seriously, they should have carpooled to D.C. driving a hybrid. So, onto Washington, pinky ring adorned hands out, looking for cash and finally someone cowboys up.

"You traveled in a private jet? I'm not an opponent of private flights by any means, but the fact that you flew in on your own private jet at tens of thousands itself dollars of cost just for you to make your way to Washington is a bit arrogant before you ask the taxpayers for money."

Rep. Patrick McHenry said what everyone else was thinking. Then, others got in on the act and pretty much blasted the CEO’s hollow pleas for money wrapped up in a snappy commercial for their autos. Then David Scott volleyed this non sequitur, the Titanic’s biggest problem wasn’t the collision with the iceberg. I can only imagine the room got silent for a second and then everyone kind of nodded and understood the analogy. Mouthpieces for the auto makers pleaded that they had already done everything they could to stave off bankruptcy. At that moment, the deafening sound of an alarm went off and Wagoner reached into his pocket to push the “alarm off” button on the key ring to his jet.

This time, the snakes can walk

Look, I understand that as a CEO you have a very prestigious and high ranking position in a company. You’re the boss. With that position comes a pretty decent pay grade. But that doesn’t give you the right to be a douche bag and lay off hard workers and steal the pensions of those who have worked for a company for 30 plus years. That’s employee loyalty. CEO’s come and go at a fraction of that time. They seem to come in, puff out their chest, take the golden parachutes and jump out of the plane. Let me clue you in to what a real CEO or founder of a company does when his company is in financial trouble. The company I work for started in the home of our founder. He wanted to develop devices to help patients tolerate treatment better. After he got up and running as an established company he found himself in some tough times. He and a few of his backers managed to forgo their own salaries just to make sure they made payroll. He cared that much about the people to take his pay and give it to his employees and to pay his bills in order to keep the doors open. For 32 years the company stayed in business. Some companies decide, in times of financial crisis, that it is best practice to reduce the work force. I know that the founder of a fledgling private company and the CEO of a multi billion dollar company are two different things but it seems to me that if you take care of your infrastructure and keep the foundation solid, growth can occur without weakening the base. If you over inflate the top, the tower falls over. This is why I'd never do well as a business major.

Now, if it wasn’t for the failing economy’s dependency on the auto industry, I’d say let them fail. I'm not even talking about the buying of cars, but the auto industry employs so many people and that is a lot of jobs to eliminate putting unneeded stress on an already growing unemployment rate. But, just like the housing and credit market, it has to work from the bottom up. The consumer has to purchase a car to help shore up the company. Again, there isn't enough bailout money in the world to give each and every individual, in America, over the age of 16 a check to go buy a car. I don't have any suggestions other than the obvious. Get rid of the Big Three's paychecks, bonuses, and other compensation and funnel that into the companies as operating capital, payroll, benefits, pensions, and restructure the companies. It's a long road to recovery but when three jack asses go to Washington on a private plane, why should the blue collar and middle class car owner give them anymore money when they don't even want to drive.

Update 12/16/08

My fellow blogger over at The Blathering posted avery good and hillarious argument towards giving the auto industry bailout funds. Of course, it was disguised in the form of a post about crushing on Jon Stewart, however, I still admit she has a point.

Monday, November 24, 2008

Bailout, Bailout, Wall Street Let the Bear Out

I’m not going to go into a complete history of what’s been going on, nor am I going to point fingers of blame at any Presidential administration. There is enough blame to go around on both sides of the coin. You know the economy must be really bad when Days of Our Lives has to fire Deidre Hall and Drake Hogestyn just to be able to stay on the air for 18 more months. Even fictional television is feeling the burden.

The reality is that we have failed to learn from history and are now forced to repeat it. In another 20 years, we’ll probably do the same thing. Look at the current economical situation in terms of a scene from The Matrix Reloaded where Neo reaches The Architect and finds out that he is the eventuality of an anomaly. The economy functions in a state being where, if it were Utopian, by nature, it would ultimately fail. If it (we) were allowed a choice in matter we would accept it, provided we were given just that, a choice. Granted, the small amount of those who chose to reject it will ultimately grow and eventually the system will crash, reboot, and start all over again. Everything is cyclical.

"Whoa! The Economy is complicated."

The fact that it takes decades at a time is unnoticed and therefore ignored. When it does happen, everybody goes nuts and declares it to bet the biggest disaster since the last time it happened. The benchmark appears to be The Great Depression. Perhaps the geniuses that came up the name for the current situation should have gone with a comparative term such as The Greater Depression instead of the more diluted and less romanticized terms, Global Financial Crisis of 2008, The Sub-Prime Mortgage Crisis, or Emergency Economic Stabilization Act of 2008.

However, what’s past is prologue. We’re not going to dissect what caused the issue. We’re here to dissect the continually prolonging of the solution. Unfortunately, we can’t go the same route as The Great Depression in terms of fixing the issue. We’re already at war in two countries. The EESA of 08 or Bailout, Rescue, whatever was supposed to purchase “toxic”(….ooh I like that word) mortgage backed securities in an effort reduce uncertainty of the solvency of financial institutions and restore confidence in the credit markets. In other words. The government takes a crap load of money and pays for the mistake supposedly in an effort to give Wall Street a chance to shore up their holdings. Let me ask you this. If you have a friend who is an addict, do you give them access to their vice? “Sure, Bob. I’m glad you admitted that you have a drinking problem. Why not join me in a glass of champagne to celebrate your first step towards sobriety?” Then Bob goes out and kills three people and a dog while driving home loaded. Oh, and Bob decided to stop at three more bars on the way home. Bob is AIG. Yeah, purportedly by the end of October, AIG spent nearly $90 billion of the $123 billion in bailout money. Almost $1 million dollars of whatever money they had was spent on lavish trips to England, Phoenix, and California for retreats of various kinds. Now, all of a sudden, they’re walking up to the front of the lunch line, bowl in hand saying, “Please, Sir, I want some more.” Apparently, AIG handles money the way a compulsive gambler handles flipping a coin. They don’t flip the coin. They put the coin on black 22 at the roulette table.

So, with major financial institutions failing, merging, failing, partying, etc. we sit idly by and wait for the problem to just go away as if we can reboot a computer. Unfortunately, the problem is the blue screen of death and attempts to reboot the economy have been unsuccessful. Now, while it is obvious that Wall Street has a problem with managing money, so do we. It's not that I don't believe that trickle up economics or other euphemisms for giving the money to the people won't work. It's just that I, like so many other people have been digging holes that need to be filled. We get money from the government in the form of stimulus checks that are supposed to be used to go out and by goods and services and yet we spend it on debt reduction. Actually, in this case, that might help. Regardless, there have been numerous chain emails and other discussions around the water cooler about giving the $700 billion to the American people. This won't work either.

If you look at the U.S. population as of 2008, it stands at roughly, 305 million. For argument's sake, let's say that 200 million people own a mortgage or have substantial debt above $50,000. If you take that $700 billion dollars and divide it by 200 million, you only get $3500 before taxes. I don't see anyone paying off a mortgage with that much, unless you are a thimble and your mortgages consist of Boardwalk and Park Place. If you slice it another way, take a $100,000 mortgage and divide that into $700 billion. You would only be able to help 7 million people before you run out of cash.As bad as Wall Street is with money, the general lynch mob is equally bad at math. They are tired of Government screwing up the country and letting us take the fall. Well, guess what? We elected them.

So, what can we do? Personally, as much as I would love to have the Government give me a slice of the bailout humble pie, I'm not in that group of people who are foreclosing on a house or been affected by job layoffs...yet. So, giving me the money to pay off my mortgage doesn't solve the issue. While a lot of folks are in foreclosures because their banks got greedy, a lot of them got there themselves. They either were duped into a deceptive mortgage arrangement or figured that with the banks just giving away money, they could buy huge, half million, dollar homes and have no trouble paying them off in thirty years. Unfortunately, the banks and the economy couldn't wait that long. There's no way to fix this by giving us the money. However, I would have taken an approach much like I would have done had we, as individuals, received the money. Instead of just writing a blank check to these companies. Give them vouchers for operating capital. Make sure they use that money and restructure their balance sheet (aka bankruptcy) so that the money still had went towards becoming solvent, like paying pensions and employee salaries.

If the government had some mythical pot of gold that could be used to give the American people the money instead, I would still expect there to be two kinds of vouchers. One goes to paying a mortgage and only a mortgage. The other would go towards economic stimulus. It could be in the form of a voucher to buy a vehicle and help the auto industry. While, I'm not going to complain when President-Elect Obama pushes through another stimulus package, I believe if their intent is to have us spend the money on goods and services then they should have issued us the checks before the end of October. That way, we would have money to be used for shopping through the end of the year. Think of it like a book of coupons you get at McDonald's or the movie theater. Within the booklet you have several coupons that are good for the purchase of different types of food and drink. If you wait until after the holidays when Obama takes office, a lot of the damage will be done. Regardless of how much they promise stimulus checks in the New Year, the stores are hurting now and people are leery of loading up a credit card now when the banks and credit institutions are hurting. If you miss a payment, the penalties can be severe.

Well, that's my thoughts in a nutshell. For a lot of us this is a scary time where we are stuck banging our heads against the wall while Wall Street tells us they're pregnant. We're just trying to do the math in our heads in hopes that we weren't the one responsible. And while we resign ourselves to having to grow and learn responsibility, Wall Street is out there drinking and smoking with a baby bump. For the rest the country, everything is just status quo. If you're really savvy you can take huge advantages of the situation in terms of buying a car and shopping. Prices will go down, gas has gone down, and auto dealers are hurting for business. If Warren Buffet can afford to play the game with millions of dollars on Wall Street, why can't Mongo the Middle Class mensch play the game on Main Street. So, hang in there, things will eventually start to look up. Just don't hope for the best, prepare yourself for the long haul. After all, "Hope, it is the quintessential human delusion, simultaneously the source of your greatest strength, and your greatest weakness. "

Monday, November 17, 2008

Playing House of Cards

Recently, I reconnected with an old high school friend of mine on Facebook. In between saving the rain forests and making flair for the masses we got into a conversation about our childhoods. She, the daughter of a dentist, and I, the son of an Insurance Agent, both grew up in middle class suburbia. Every year they went to Florida for Christmas and I wished I could. Yet, I never went without the essentials, and on occasion we took a family vacation at the beach. While, the contrast in our lives may have seemed great, the end result was the same. We both knew nothing of what our parents had to do in order to give us those lives.

Now, we both have spouses and children and mortgages and everything that comes with it. In the middle of all this we, like many other Americans face the doom and gloom of the current financial crisis with uncertainty and trepidation. While I can't speak for her I can tell you that there are times I wonder if I'm not scared enough for my solvency. I'm sure my wife can worry enough for both of us, but I don't seem to be too afraid of the next down day on the Dow. Why? Because I didn't get in over my head when the glass ceiling was as vaulted as the half million dollar homes bought and sold on the sub prime mortgage market.

I spent a month jumping through hoops to get a first time home buyer's loan from the state in order to secure a lower interest rate. I have a 30 year mortgage at a fixed rate of 4.55%. We bought our house in 2004 at the height of the housing boom. Left and right people were getting those pie in the sky brick homes in tightly spaced, treeless, housing plans where you measure success not only by the size of your bank account but by the height of the grass on your lawn and the rules governing it. While salivating sellers were being lead around by Realtors touting over inflated listing prices and blinded buyers were convinced that they could afford any price based on the mythical mortgages offered, I was looking at a middle of the road price tag on what could be a starter home without the structural deficiencies that would be beguile a budding buyer. In short, I went vanilla.

Vanilla's not so bad, looking back now. My mortgage gets paid every month on time with no worries and by my calculations, I'd be paying the same, if not more, in rent for my townhouse where I previously resided. We have one car payment and are slowly chipping away at one credit card that has followed us around since our engagement. I'd say vanilla tastes pretty good about now.

In terms of employment, I'm still on the fence with that one. I want to believe that my job is secure, but I see the signs on the wall. It may not be tomorrow or next week, but eventually my position may be eliminated. The problem with being owned by a bigger corporation, based in another country, is that even though we meet or exceed market expectations for 20+ continuous quarters doesn't mean we don't have to suffer when the economy tanks. Workforce reductions and spending freezes affect us all and I'm still actively searching for another job. But the work is there and it's keeping me busy, which is probably a good thing when "The Bobs" finally come around.

The trick has been not to show signs of weakness, anywhere. I'm the sole income stream. I'm one half of the decision team. The world can come crumbling down around me and I have to remain calm for my wife, and more importantly, my daughter. She's still too young to comprehend any of the issues going on in the world but she picks up on stress and negativity very well. It was that conversation about my childhood that got me thinking. Perhaps things weren't that great. Perhaps my parents were just real good at hiding the truth. In the 80's we had that little problem called the S&L scandal and the economy tanked in August on Black Monday. If everything is indeed cyclical, we should have seen this coming back around. I had no clue what happened but heard from friends and saw on the news that the economy was in trouble. Maybe my parents' vanilla lifestyle kept us out of danger or maybe they just hid the problems and managed their finances in such a way that we rode out the worst with little effect.

Regardless of how things happened, I went about my business playing video games and baseball with my friends. Now, 20 years later I'm in the same boat as my parents were. Yet, here I am making sure that my daughter's second Christmas is one for the books. She'll have her kitchen play set and they'll be no need for her to reenact the struggles of the middle class around her small kitchen table with her Winnie the Pooh filling in for Suze Orman and Rabbit, the collection agent, calling her on her PlaySkool phone, looking for delinquent credit card payments. I intend for her to not worry about the issues we face as adults. She's a kid and needs to be a kid for as long as possible. Childhood doesn't last long enough and is only a fraction of our lifespan. Besides, if she's really hell bent on helping out, we'll set up a Snoopy Snow Cone Starbucks and she can make biscotti with her Easy Bake Oven. We'll even put put out a tip jar to help dear old Dad pay for her convertible power wheels. It's the least we can do to help the cause.